Welcome to

Pension Planning

Center

When you will legally retire around 65, you will need to have saved enough to finance your life. Luckily, Belgium provides tax advantageous savings options. We help you navigate these, always with our ETF investment approach.

Find a suitable plan for

Pension Plan Employees

The first ETF-based pension plan for employees in Belgium. The best experience for employers.

Learn morePension Savings

Invest 980€ per year, get 30% back. The must-have for all citizens.

Existing plans transfer?

Do you want to transfer an old plan to Easyvest? Do you want your existing group-insurance or CIPA to be invested in ETF? It might possible, get in touch here.

Join 5.372 satisfied customers

We already manage €377 million for them.

I have an investment account where I add money on a regular basis to buy a house in 5 years.

Alexia Z., 28 yo

Company director, I plan my pension with tax efficient CIPA and an investment account.

David M., 37 yo

We have a joint account aiming at generating an automatic annuity while preserving our capital.

Elisabeth & Pierre B., 66 yo

I have a family investment account used to progressively pass on my estate to my children.

Michel R., 68 yo

Take control of

your pension

Collect all your pension data in one app and start an investment plan to prepare for your pension.

Download our free app

Download our free app

How it works?

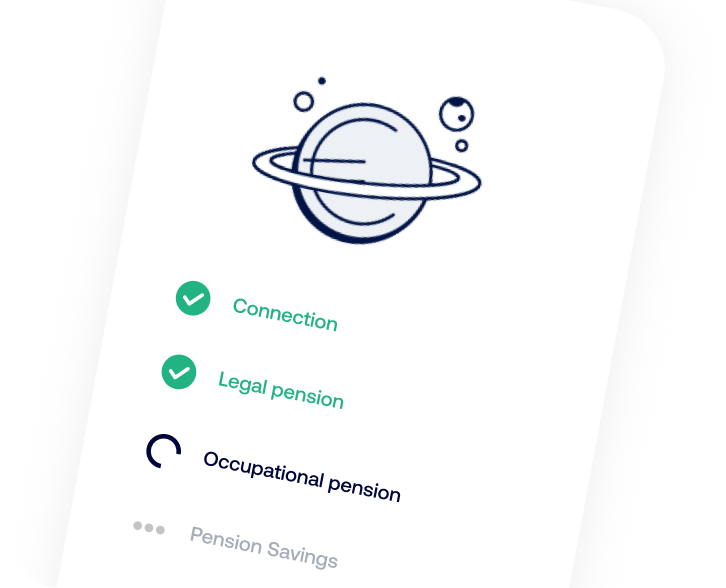

Gather your data

Find all your pension data (legal pension, pension savings,...) in our app by simply logging in via itsme®.

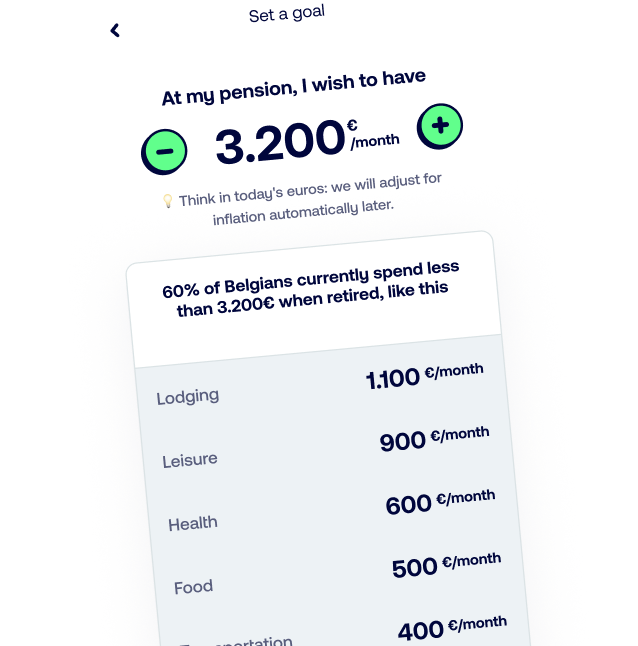

Define your goal

Determine how much money you will need to live comfortably after you retire.

Invest for your pension

Start an investment plan to reach your goal with our personalized advice.